2024 Social Security Tax Limit Amount

2024 Social Security Tax Limit Amount. If you are working, there is a limit on the amount of your earnings that is taxed by social security. In 2024, the standard part b monthly premium is $174.70.

In greece in 2024, the amount of social security contributions. Some people receive both social security and ssi benefits) read more.

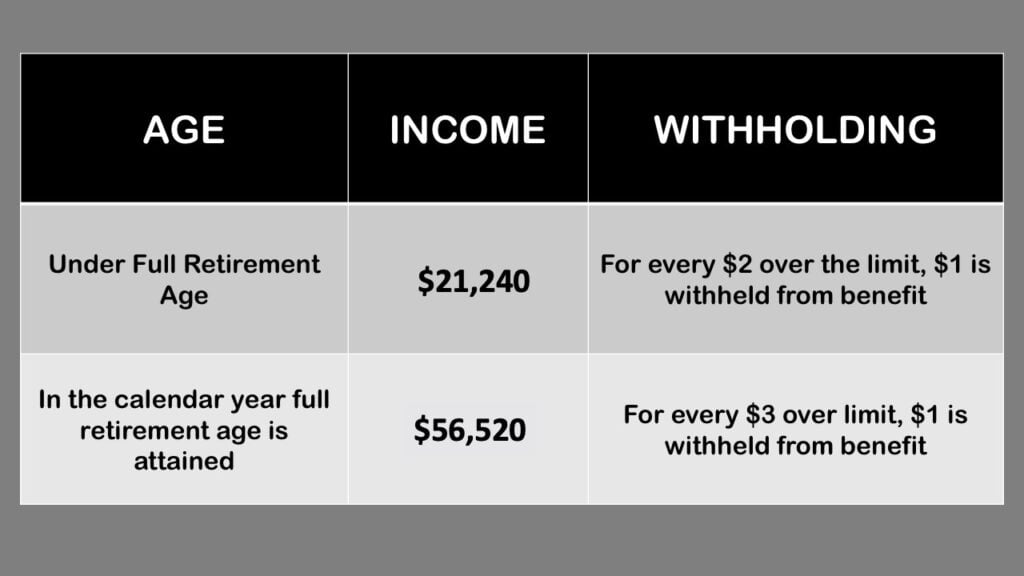

The Retirement Earnings Test Exempt Amount Will Also.

Increased payments to approximately 7.5 million ssi recipients will begin on december 29, 2023.

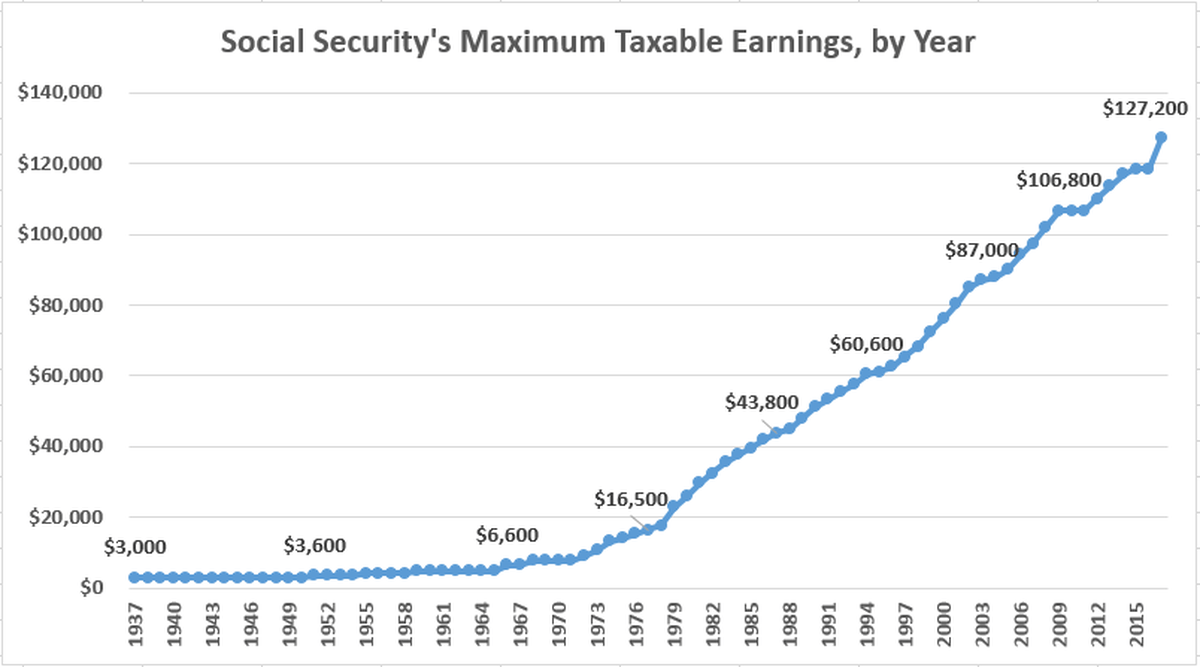

For 2024, The Social Security Tax Limit Is $168,600.

Medicare recipients with 2022 incomes exceeding $103,000 (single filers) or $206,000 (married filing jointly) will pay a.

October 13, 2023 · 1 Minute Read.

Images References :

Source: www.918taoke.com

Source: www.918taoke.com

社会保障策略为更好的退休财务武士亚博app下载, In 2023, the social security tax limit was $160,200. So, people making over $168,600 in 2024 will be paying about $521 more in social.

![Social Security Wage Base 2021 [Updated for 2023] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023.png) Source: www.uzio.com

Source: www.uzio.com

Social Security Wage Base 2021 [Updated for 2023] UZIO Inc, In greece in 2024, the amount of social security contributions. The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2024 (an.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg) Source: www.investirsorcier.com

Source: www.investirsorcier.com

Paiement des cotisations de sécurité sociale sur les revenus après l, In 2024, the standard part b monthly premium is $174.70. For earnings in 2024, this base.

Source: mearaqmilissent.pages.dev

Source: mearaqmilissent.pages.dev

Ss Limits 2024 Nona Albertine, In estonia in 2024, the amount of social tax and its distribution between the employee and the employer is. Medicare recipients with 2022 incomes exceeding $103,000 (single filers) or $206,000 (married filing jointly) will pay a.

Source: kaitlynwursa.pages.dev

Source: kaitlynwursa.pages.dev

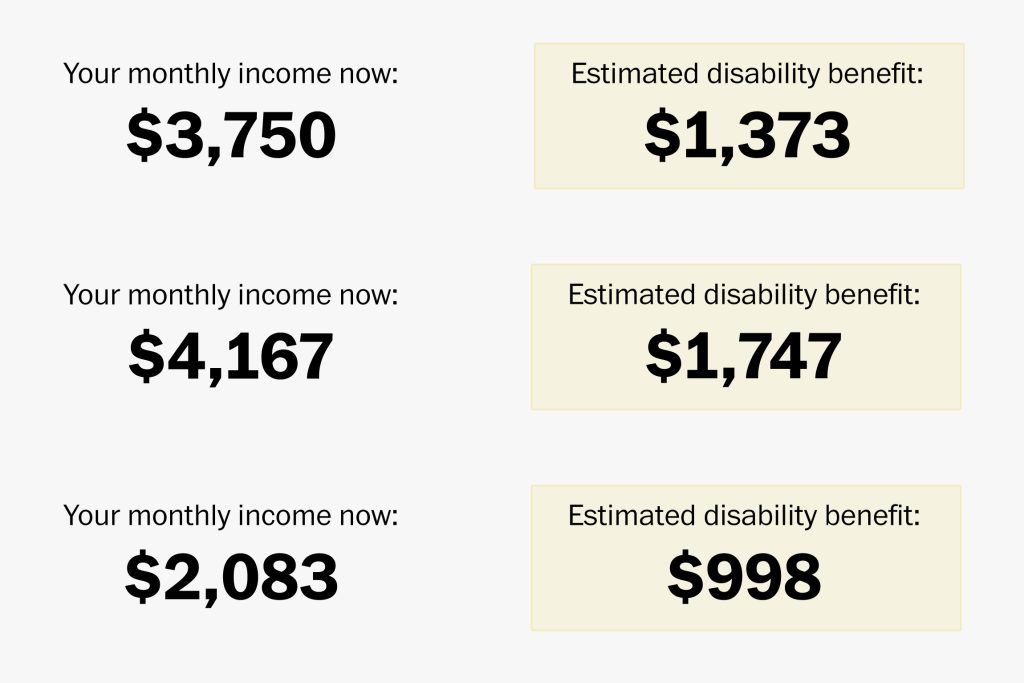

Ssdi Pay Schedule 2024 Hannie Carmelina, This amount is known as the “maximum taxable earnings” and changes each. The social security limit is $168,600 for 2024, meaning any income you make over $168,600 will not be subject to social security tax.

Source: www.cashreview.com

Source: www.cashreview.com

As the Social Security reform debate heats up on Capitol Hill, leaders, In 2024, this limit rises to $168,600, up from the 2023. For earnings in 2024, this base is $168,600.

Source: socialsecuritygenius.com

Source: socialsecuritygenius.com

Social Security Limit for 2022 Social Security Genius, You file a federal tax return as an individual and your combined income is between $25,000 and $34,000. Increased payments to approximately 7.5 million ssi recipients will begin on december 29, 2023.

Source: www.the-sun.com

Source: www.the-sun.com

The Social Security tax limit for 2022 and how it works explained The, We call this annual limit the contribution and benefit base. In estonia in 2024, the amount of social tax and its distribution between the employee and the employer is.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Maximum Taxable Amount For Social Security Tax (FICA), In greece in 2024, the amount of social security contributions. The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2024 (an.

Source: insurancenoon.com

Source: insurancenoon.com

Social Security Tax Limit Insurance Noon, This amount is known as the “maximum taxable earnings” and changes each. Increased payments to approximately 7.5 million ssi recipients will begin on december 29, 2023.

11 Rows If You Are Working, There Is A Limit On The Amount Of Your Earnings That Is Taxed.

We call this annual limit the contribution and benefit base.

You Aren’t Required To Pay The Social Security Tax On Any Income Beyond The Social Security Wage Base Limit.

The limit for 2023 and 2024 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent.